05/07/ · How to compute how much you loose in forex trade. When the market price changes from to, you lose USD from Trade 1 The account balance is 10, USD, but the equity is 9, USD. Trade 3: You sell lots with an opening trade at a market price of When the market price changes to, you make a 50 USD profit from Trade 1 and USD from Trade 2 Forex lot Now that you know how forex is traded, it’s time to learn how to calculate your profits and losses. When you close out a trade, take the price (exchange rate) when selling the base currency and subtract the price when buying the base currency, then multiply the difference by the transaction size. That will give you your profit or loss Trade 1: You buy lots with an opening trade at a market price of Trade 2: You buy lots with an opening trade at a market price of When the market price changes to , you make 50 USD profit from Trade 1and USD from Trade 2, both of which are reflected in the account equity. The account balance is 10, USD, but the equity is 10, USD

Calculating Profits and Losses of Your Currency Trades

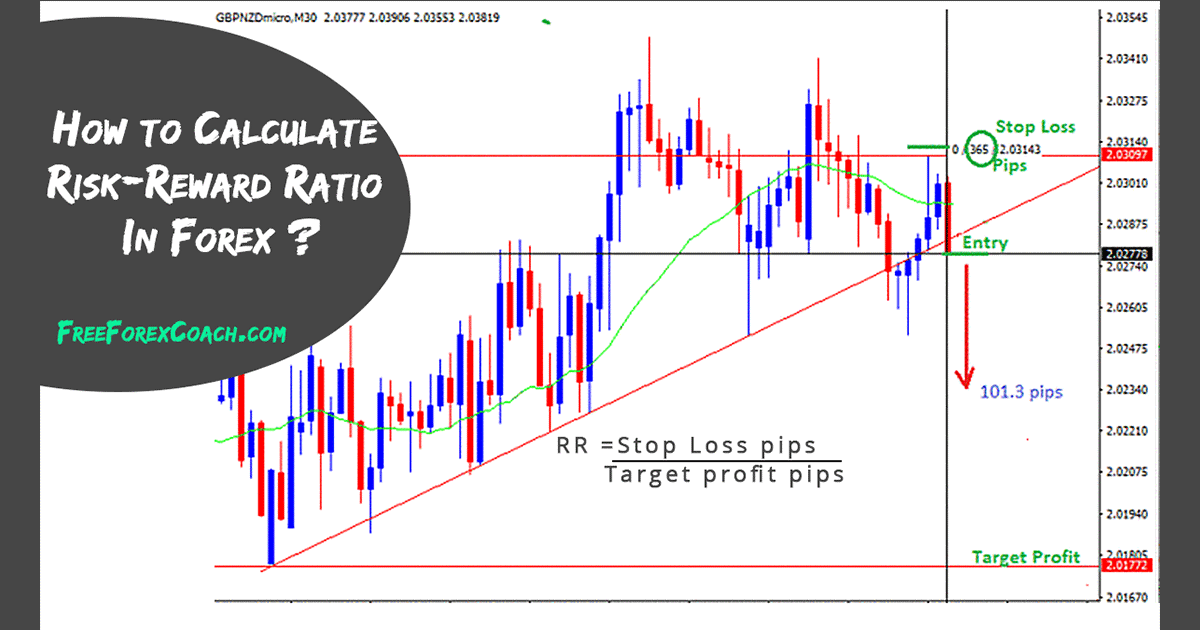

When the market price changes from toyou lose USD from Trade 1 The account balance is 10, USD, but the equity is 9, USD. Trade 3: You sell lots with an opening trade at a market price of When the market price changes toyou make a 50 USD profit from Trade 1 and USD from Trade 2 Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss.

In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size number of units for currency pair in the last blogger. As a day trader, you should always use a stop-loss order on your trades.

Barring slippage, the stop-loss lets you know how much you stand to lose on a given trade. A good stop-loss strategy involves placing your stop-loss at a location where, if hit, you would know that you were wrong about the direction of the market. You probably won't have the luck of perfectly timing all your trades.

As much as you'd like it to, the price won't always shoot up right after you buy a stock. Therefore, when you buy, give the trade a bit of room to move before it starts to go up. Instead of trying to prevent any loss, a stop-loss is intended to exit a position if the price drops so much that you obviously had the wrong expectation about the market's direction.

As a general guideline, when you buy stock, place your stop-loss price below a recent price bar low a "swing low". Which price bar you select to place your stop-loss below will vary by strategy, but this makes a logical stop-loss location, because the price bounced off that low point, how to compute how much you loose in forex trade.

If the price moves below that low, how to compute how much you loose in forex tradeyou may be wrong about the market direction, and you'll know that it's time to exit the trade. It can help to study charts and look for visual cues, as well as crunching the numbers to look at hard how to compute how much you loose in forex trade. As a general guideline, when you are short-selling, place a stop-loss above a how to compute how much you loose in forex trade price bar high a "swing high".

Which price bar you select to place your stop-loss above will vary by strategy, just like stop-loss orders for buys, but this gives you a logical stop-loss location, how to compute how much you loose in forex tradehow to compute how much you loose in forex trade, because the price dropped off that high.

Studying charts to look for the swing high is similar to looking for the swing low. Your stop-loss placement can be calculated in two different ways: cents or ticks or pips at risk, and account-dollars at risk. The strategy that emphasizes account-dollars at risk provides much more important information, because it lets you know how much of your account you have risked on the trade.

It's also important to take note of the cents or pips or ticks at risk, but it works better for simply relaying information. For example, your stop is at X, and long entry is Y, so you would calculate the difference as follows:.

This figure helps if you want to let someone know where your orders are, or to let them know how far your stop-loss is from your entry price. It does not tell you or someone else how much of your account you have risked on the trade, though. To calculate how many dollars of your account you have at risk, you need to know the cents or ticks or pips at risk, and also your position size.

Let's say you have a position size of 1, shares. Pips at risk How to compute how much you loose in forex trade Pip value X position size. Your dollar risk in how to compute how much you loose in forex trade futures position is calculated the same as a forex trade, except instead of pip value, you would use a tick value. If you buy three contracts, you would calculate your dollar risk as follows:. The number of dollars you have at risk should represent only a small portion of your total trading account.

Quickly work the other way to see how much you can risk per trade. Always use a stop-loss, and examine your strategy to determine the appropriate placement for your stop-loss order. Depending on the strategy, your cents or pips or ticks at risk may be different on each trade. That's because the stop-loss should be placed strategically for each trade. The stop-loss should only be hit if you incorrectly predicted the direction of the market.

You need to know your cents or ticks or pips at risk on each trade, because that allows you to calculate your dollars at risk, which is a much more important calculation, and one that guides your future trades.

Trading Day Trading. Table of Contents Expand. Table of Contents. Correctly Placing a Stop-Loss. Calculating Your Placement. Control Your Account Risk. The Bottom Line. By Full Bio. Adam Milton is a former contributor to The Balance. He is a professional financial trader in a variety of European, U.

Read The Balance's editorial policies. Reviewed by. Full Bio Follow Linkedin. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. He has provided education to individual traders and investors for over 20 years.

He formerly served as the Managing Director of the CMT® Program for the CMT Association. Article Reviewed on February 13, Read The Balance's Financial Review Board. Key Takeaways Stop-loss orders act as an alarm when trading stocks, pulling the plug when you're wrong about the anticipated direction of the market. They'll exit when a stock has fallen below your acceptable threshold. You can calculate stop-loss based on the cents or ticks or pips you have at risk, or on the amount of dollars at risk.

Article Sources. Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. comted Reading Time: 4 mins When the market price changes from toyou lose How to compute how much you loose in forex trade from Trade 1 The account balance is 10, USD, but the equity is 9, USD. follow this money management ratio and you won't lost that much. unless your strategy is good, you can trade for just 2 or 3k deposit.

Post a Comment. Promo code: ICICI Offer valid till December 31, Cl Monday, July 5, How to compute how much you loose in forex trade. How to compute how much you loose in forex trade When the market price changes from toyou lose USD from Trade 1 The account balance is 10, USD, but the equity is 9, USD. at July 05, Email This BlogThis! Share to Twitter Share to Facebook Share to Pinterest.

Labels: No comments:. Newer Post Older Post Home, how to compute how much you loose in forex trade. Subscribe to: Post Comments Atom.

How To Calculate Profit In Forex

, time: 6:54Binary options Singapore: How to compute how much you loose in forex trade

Now that you know how forex is traded, it’s time to learn how to calculate your profits and losses. When you close out a trade, take the price (exchange rate) when selling the base currency and subtract the price when buying the base currency, then multiply the difference by the transaction size. That will give you your profit or loss Trade 1: You buy lots with an opening trade at a market price of Trade 2: You buy lots with an opening trade at a market price of When the market price changes to , you make 50 USD profit from Trade 1and USD from Trade 2, both of which are reflected in the account equity. The account balance is 10, USD, but the equity is 10, USD 05/07/ · How to compute how much you loose in forex trade. When the market price changes from to, you lose USD from Trade 1 The account balance is 10, USD, but the equity is 9, USD. Trade 3: You sell lots with an opening trade at a market price of When the market price changes to, you make a 50 USD profit from Trade 1 and USD from Trade 2 Forex lot

No comments:

Post a Comment