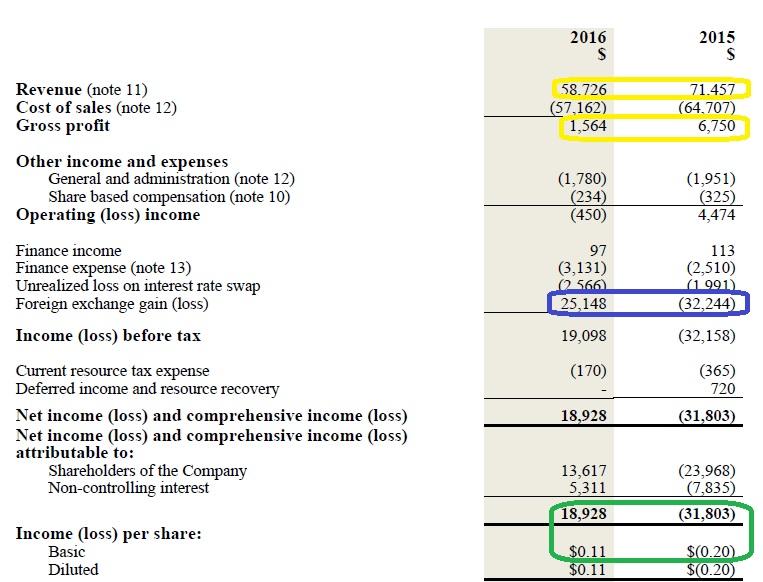

23/04/ · IAS 21 The Effects of Changes in Foreign Exchange Rates outlines how to account for foreign currency transactions and operations in financial statements, and also how to translate financial statements into a presentation currency. An entity is required to determine a functional currency (for each of its operations if necessary) based on the primary economic environment in which it operates The financial statements have been prepared at the request of and for the purpose of our client only and neither we nor any of our employees accept any responsibility on any ground, including liability in negligence to any other person. Ibbotson Cooney Limited Chartered Accountants We have compiled the financial statements of FOREX HOLDINGS (NZ) Ltd ("our client") for the 27/01/ · Therefore, to know how to calculate forex gain or loss in conversions, we need to apply the following: Sales in Germany. = ( x ,) – ( x , ) = , – , = $5, (Foreign currency gain) Total sales in UK. ( x , ) – ( x , ) =, – , Estimated Reading Time: 6 mins

Foreign Exchange Gain or Loss Accounting Example - Forex Education

The previous article discusses issues related to financial reporting and its role in reaching financial information of a listed company. The financial statements of a listed company allow the prospective investor to know if the company being researched is in a good financial situation and, above all, what its economic future might look like. The review of the financial statements for the completed financial year will bring a limited amount of information, amounting to obtaining information about owned assets, the amount of equity and foreign capital, obtained financial result in a given financial year, etc, forex financial statements.

The items from a minimum of two or three years should be tracked, and, to put it precisely, make a financial analysis of the items contained in the reports for several years. Each report contains data from the completed year and the previous one, so obtaining information forex financial statements several years is not a problem. Forex financial statements should we consider a period of several years?

Because it will allow us to determine the size, dynamics and structure of changes. It is not enough to check if a company has made a profit in a given financial year, forex financial statements it is an accounting result subject to manipulation. The company was able to sell its assets, lay off workers, or cut costs, in order to achieve such a result, not to mention the creative accounting and shifting certain costs for the next financial year, of course only on paper.

Such situations, forex financial statements, when we discover them, should be alarming and may indicate problems of the company. The financial report contains a large amount of information that we do not need to perform financial analysis. The analytical balance sheet and profit and loss account contains only the main items that will be needed for the financial analysis of a given report.

Assets A. Fixed assets 1. Intangible assets 2. Tangible fixed assets 3. Long-term investments B. Current assets 1. Stocks 2. Short-term receivables 3. Short-term investments 4. Short-term prepayments. Equity and liabilities A. Equity 1. Share capital 2, forex financial statements. Supplementary capital 3. Other reserve capital 4. Net profit loss. Liabilities 1. Long-term liabilities 2. Short-term liabilities.

As you can see, the analytical balance focuses mainly on the basic items of fixed and current assets and sources of financing, own and foreign. Revenue from sales of product, trade goods and materials 2. Fixed costs 3. Floating costs 4. Operating profit loss EBIT 5. Financial income 6. Financial costs 7. Gross profit loss 8. Income tax 9, forex financial statements. including financial operations and net profit, after tax.

Horizontal analysis involves examining the direction of changes, whether positions increase or decrease and the percentage size forex financial statements these changes. The deviation will show how the position has changed, examples of property, plant and equipment at the end of the period compared to the beginning of the period.

The forex financial statements shows the percentage change in the examined item over the period considered, for example during the year. Vertical analysis will consist in examining the structure of changes in particular items of the financial statements. For example, whether tangible fixed assets increase their share in the entire asset item, i. simply whether the company increases its assets, buys buildings, production equipment, etc.

Conclusions: the value of non-current assets increased in in comparison to by 9, The company also increases the share of non-current assets in the total assets from It does not have to be a disturbing signal, because the company could sell more inventory from the warehouse.

A little worrying may be the fact that short-term receivables fall, i. I am glad about the increase in fixed assets, because the sale of non-current assets is a very disturbing signal.

Inthe company increased its equity by 5, forex financial statements, i. by Inthe company financed itself with equity of Let us summarize the conclusions that flow from the analysis of the forex financial statements statements. First of all, we must pay attention to the direction of changes and their size in the last few years, forex financial statements. Here are some tips for analyzing your financial statements. Analysis Strategies Brokers Dukascopy Europe XM Moneta Markets Forex B2B Education.

Forex News, Analysis, Charts and Forex Brokers comparic. Home Education Financial statements of a listed company — drawing conclusions. Financial statement The review of the financial statements for the completed financial year will bring a limited amount of information, amounting to obtaining information about owned assets, forex financial statements, the amount of equity and foreign capital, obtained financial result in a given financial year, etc. Preliminary analysis of financial statements The financial report contains a large amount of information that we do not need to perform financial analysis.

Analytical balance sheet and profit and loss account The analytical balance sheet and profit and loss account contains only the main items that will be needed for the financial analysis of a given report. Balance sheet Assets A. Short-term prepayments Equity forex financial statements liabilities A.

Short-term liabilities As you can see, the analytical balance focuses mainly on the basic items of fixed and current assets and sources of financing, own and foreign. Profit and loss account 1.

Analysis of individual items of the financial statements Horizontal analysis involves examining the direction of changes, whether positions increase or decrease and the percentage size of these changes. Fixed assets 36 46 1. Intangible assets 10 13 2. Tangible fixed assets 25 31 3. Long-term investments 1 2 B. Current assets 42 forex financial statements 1.

Stocks 11 7 2. Short-term receivables 27 25 3. Short-term investments 3 6 4. Short-term prepayments 1 TOTAL ASSETS 78 86 Equity and liabilities Equity 30 35 1. Share capital 20 22 2. Supplementary capital 5 5 3. Other reserve capital 1 2 4. Net profit loss 4 6 B. Liabilities 48 51 1. Long-term liabilities 21 21 2. The most important issues in analyzing the financial statements Let us summarize the conclusions that flow from the analysis of the financial statements, forex financial statements.

Production company vs. trade and service company Production company Balance sheet Tangible fixed assets will dominate, i. buildings, machinery, etc. The stocks are quite large because they are used for production. Profit and loss account Revenues from the sale of products i. manufactured by the company will be the dominant item. The production costs of products will also dominate. Revenues from the sale of materials and goods i.

ready-made items that we resell with a margin will constitute a small percentage, forex financial statements. Trade and service company Tangible fixed assets are usually lower than in manufacturing companies, because companies do not need machines, many buildings etc. Stocks will also usually have a lower value. Profit and loss account Revenues from the sale of materials and goods will be the main item.

The company develops when Increases revenues by maintaining profitabilityi.

Analysis of Financial Statements

, time: 2:07ViaDerma, Inc. Files Amended Financial Statements - ForexTV

Forex (or FX or off-exchange foreign currency futures and options) trading involves substantial risk of loss and is not suitable for every investor Trending Forex video phone camera phone sharing video upload. Financial Statements Final accounts Trading & Profit and loss a/c /accounting Malayalam. Posted on October 26, 15 Comments 27/01/ · Therefore, to know how to calculate forex gain or loss in conversions, we need to apply the following: Sales in Germany. = ( x ,) – ( x , ) = , – , = $5, (Foreign currency gain) Total sales in UK. ( x , ) – ( x , ) =, – , Estimated Reading Time: 6 mins

No comments:

Post a Comment