The Inside Bar Pattern (Break Out or Reversal Pattern) An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. Its relative position can be at the top, the middle or the bottom of the prior bar The inside bar is a candle in which the body is fully contained by its preceding candle. The Inside Bar formation suggests that the market is pausing or consolidating. The bulls cannot create pressure for a higher high and the bears cannot create a lower low. You can trade the inside bar /11/11 · Last Thoughts on the Inside Bar Forex Strategy. The inside bar as an entry signal does not offer the trader an edge over the market in most scenarios, however the inside bar used for reading the price action story can be very useful. It is important to understand why the market moves like it does

Inside Bar Forex Trading Strategy: Start to Finish Guide

Its formation takes place when the second candle is inside the preceding candle, hence the name inside bar. In the Inside Bar Candlestick Pattern, forex inside bar, the second candle is smaller than the forex inside bar candle.

It describes that the high of the second candle is lower than the first, and the low of the latter is higher than the first candle. The inside bar is usually a continuation pattern. This means that after the emergence of the Inside Bar, the price may continue to move in the same direction as before. Sometimes the Inside Bar occurs when there is pressure from sellers and buyers, forex inside bar. This shows indecision in the market as both of them were unable to push the price higher or lower.

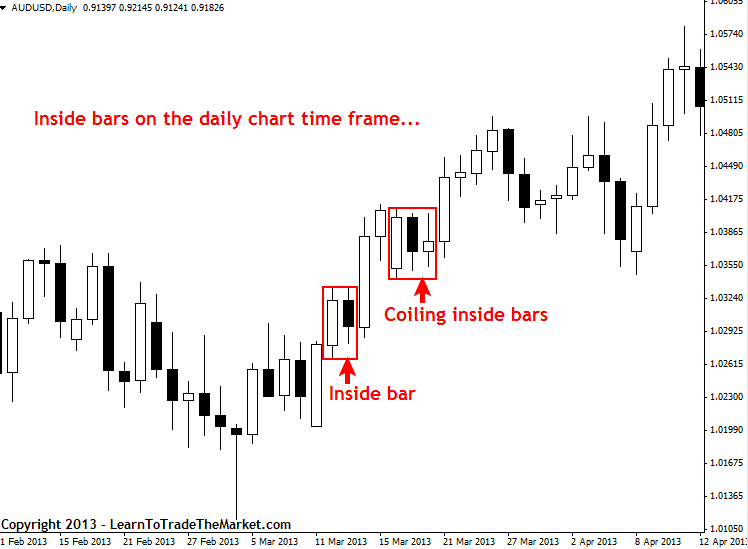

Usually, the presence of the Doji candlestick pattern before the Inside Bar confirms this uncertainty. The Inside Bar can have several inside bars within its range.

This defines a more extended consolidation period that can possibly lead to a stronger breakout. The Inside Bar is a typical pattern and can frequently appear on the forex charts.

It is essential forex inside bar remember that the appearance of the Forex inside bar Bar often signifies a serious price move, forex inside bar. As you can see in the chart above, there was an extreme market sentiment right after the Inside Bar emergence. Therefore, traders often forex inside bar the Inside Bar as a continuation pattern.

For example, if you are looking to go long, identify the Inside Bar in a bullish market, exit the trade on high, and set a stop-loss close to a low of the bar. Conversely, when going short, find the Inside Bar in a bearish trend, exit the trade on low, forex inside bar, and place a stop-loss near the high of Inside Bar.

So, they should be used in combination with other indicators like moving averages. You can notice on the chart below that right after the Inside Bar entrance; the Moving Averages are below the 0 level. So, this may be a chance to consider going short. You can spot these candlestick patterns on long and short term timeframes. They can appear on forex currency pairs, stocks, forex inside bar, indices, cryptocurrencies, commodities, metals, energies, gold, silver and more.

The Inside Bar can be used in a reversal or trend-following trading strategies. However, it may not be sensible to rely too much on this pattern alone as it can give false signals. Instead, a more complete trading strategy is to use the Inside Bar with other technical indicators and good money management.

As the Inside Bar has two candles, they can sometimes be more effective than a single candlestick pattern. But as we already mentioned, the best use of the Inside Bar is with other technical analysis and not on its own. The Inside Bar Candlestick Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy.

I would prefer to use the majority of candlestick patterns such as the Inside Bar Candlestick Pattern on the 1-hour charts and above. I tend to find that these charts contain less market noise than the lower time frames and thus give more reliable signals for forex inside bar forex trading strategies. This also means that I spend less time staring at charts and can also set alert notifications to let me know when price has reached certain levels, candlestick pattern has been formed or a particular indicator value has been reached.

The Inside Bar Candlestick Pattern is just one method of market analysis amongst thousands. I would not build a trading system alone, but rather combine with other technical indicators such as moving averages, Parabolic SAR, Stochastic Oscillator, forex inside bar, RSI, ADX and price action analysis. Of course, every trading system will generate false signals which is why money management is forex inside bar important, forex inside bar.

I would personally be implementing sensible money management and only take traders that give me a favorable risk to reward ratio, ideally of at least forex inside bar This means that one losing trade does not wipe out consecutive winners.

The methods of implementing the Inside Bar Candlestick Pattern into a trading strategy that are outlined within this article are just ideas. I would always ensure that I have good money management, trading discipline and a trading plan when using any forex strategy.

Furthermore, I would combine multiple technical analysis, fundamental analysis, price action analysis and sentiment analysis to filter all entries. You should trade forex in a way that suits your own individual style, forex inside bar, needs and goals. If you would like to practice trading with the Inside Bar Candlestick Pattern, you can open an account with a forex broker and download a trading platform.

If you are looking for a forex broker, you may wish to view my best forex brokers for some inspiration. Skip to content Best Forex Robots Best Forex Brokers Compare Forex Brokers Best Forex Signals Free Forex Robot.

Best Forex Robots Best Forex Brokers Compare Forex Brokers Best Forex Signals Free Forex Robot, forex inside bar. Search for:. Contents show.

Inside Bars - An Essential Technical Analysis Indicator

, time: 7:12The 5 Characteristics of a Profitable Inside Bar Setup

The Inside Bar Pattern (Break Out or Reversal Pattern) An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. Its relative position can be at the top, the middle or the bottom of the prior bar /11/14 · What does an inside bar mean? The inside bar forex trading strategy is a ‘flashing light’, a major signal to the trader that reversal or continuation is about to occur. An inside bar indicates a time of indecision or consolidation /09/02 · The following steps are used when identifying the inside bar pattern on forex charts: Identify a preceding trend using price action / technical indicators Locate inside bar pattern whereby the inside bar is engulfed fully by the preceding candle high and low

No comments:

Post a Comment