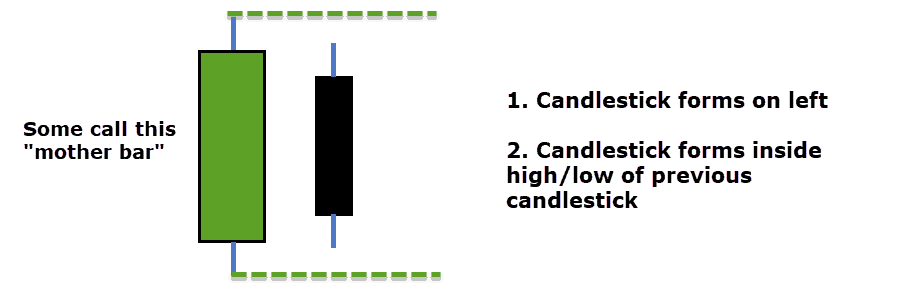

· Last Thoughts on the Inside Bar Forex Strategy. The inside bar as an entry signal does not offer the trader an edge over the market in most scenarios, however the inside bar used for reading the price action story can be very useful. It is important to understand why the market moves like it does The inside bar is a candle in which the body is fully contained by its preceding candle. The Inside Bar formation suggests that the market is pausing or consolidating. The bulls cannot create pressure for a higher high and the bears cannot create a lower low. You can trade the inside bar The Inside Bar Pattern (Break Out or Reversal Pattern) An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. Its relative position can be at the top, the middle or the bottom of the prior bar

Inside bar price action Pattern Definition. How to trade?

Introduction: The underlying concept of Inside Bar Breakout Trading Strategy is based on the process of accumulation and distribution which is also known as consolidation at key support and resistance areas respectively by big players and then the breakout thereof.

This article comprehensively deals with the various aspects of trading breakouts of Inside Bars from a daily chart perspective. Guest post by Anatasius from www. The Inside Bar Breakout Strategy gets the distinction mainly due to the simplicity of application and huge reward it offers compared to the amount of risk undertaken.

For the better understanding of an Inside Bar, its structure and its precedence, you can see the illustration below. Key resistance area : At a point of strong resistance, forex inside bar, big time sellers start building short positions and the buyers start covering their longs. This activity of exchange of hands takes place in a small range of price area which leads to a remote activity resulting forex inside bar an inside bar.

Such key resistance or support area can be a big round number, a fib level, a trend line or a confluence area. In the below illustration as we can notice, after a prolonged up move price goes for a retest at a key resistance area and forms an Inside Day.

The breakout downside leads to steep reversal. Illustration 2: Inside Bar at a key resistance area resulting in strong reversal. Key support area : It is exactly the vice versa of the above noted activity and in this case at a strong support area big time buyers start building long positions whereas the sellers start covering their shorts.

Such an action of exchange of hands in a remote range leads to an inside bar. As one can notice in the illustration below, forex inside bar, An Inside Day occurs at a key support area. Once the high of that Inside Day is taken out price rallies with heavy momentum.

An area of key resistance or support gets broken only when there are a large numbers of players willing to bid above or offer below such key areas respectively. It is common to have Inside Days in those consolidation areas before a strong breakout of key resistance or support.

In the illustration below multiple Inside Days show the process of accumulation before the price breaks the key resistance area.

Illustration 4: Inside Bars forming at a breakout area and then the price breaking the Key resistance with momentum. When the price makes a substantial move in a single direction, it halts and starts consolidating to facilitate the below noted parties, before it makes next round of movement in the same direction.

When so many parties get involved in exchange of hands at a key price level, it naturally leads to a huge consolidation represented by Inside Days, forex inside bar. More than quite often, you will notice an Inside day after a strong initial rally or decline in the price. This type of Inside day will fall under this category.

Illustration 5: After initial rally, price starts consolidating and forms an Inside bar. Again the price makes second round of rally and forms an Inside bar indicating accumulation before next leg of up move, forex inside bar.

When the big time players take no interest in the market, forex inside bar, the liquidity dries up and the price stops making any substantial moves leaving the market in a small range.

Whenever the institutional traders stay away from market activity, price has nowhere to go but to trade in a narrow range. This period of indecision may last for long depending on various factors. As a consequence, price is reflected through multiple Inside Bars. Illustration 6. Market goes in to a range and we get multiple Inside Bars within very short span of time.

A trader needs to exercise enough caution against such Inside Bars. The success, efficiency and the effectiveness of trading the Inside Bars largely depends on spotting the highly reliable Inside Bars.

It is important to note that forex inside bar Inside Bars cannot be traded profitably. To ensure that we trade only reliable Forex inside bar Bars, following guidelines are of utmost importance.

Time frame :. Trend :. We are aware that big money is always with the trend. Hence as a thumb rule, we avoid trading Inside Bars against an ongoing trend. To mitigate the risk to the possible extent as well as to magnify our gains, we always trade in the direction of the trend. For example if the major daily trend is long, we trade Inside Bars only on the long side and avoid opening shorts.

It is a proven fact that most of the large drawdown in trading accounts are due to counter trend trades. It is pertinent to note that all profitable traders are always in sync with the thought process of big players in the market.

Trend always signifies the opted direction of institutional traders. Period :. Inside bar formed during a low liquidity period must be ignored. Examples are Christmas holidays, all US Bank holidays and other holidays when big ticket players remain absent from the market, forex inside bar. During these periods, due to non presence of big time players, the range shrinks and forex inside bar chart will start printing Inside Bars, forex inside bar.

Since these Inside Bars are formed as a result of low liquidity and not due to a process of accumulation and distribution i. Entry: We make entry on the breakout of an Inside bar, in the direction of trend baring cases of reversals. Just to understand, In case the overall trend is up, we go long with the breakout on the upper side. Forex inside bar this context, it is very important to note that we make the entry with the momentum as most of the breakouts without momentum end up with false breakouts.

For ascertaining the momentum, one can scale down to next lower timeframes like 4 hour, 2 hour or 1 hour charts respectively, forex inside bar. Stop: We place the stops in a sensible way so as to make it neither too big nor too small. Under this strategy we always place the stops on either side of the Inside Bar depending on which side of forex inside bar market we are trading. Inside Bar Breakout Strategy offers very low risk Almost nil!

entries and extraordinary returns on trades. A Risk is to Return of and are quite common under this strategy. Just to give you an idea, forex inside bar, because of the incredible risk reward ratio this strategy has to offer, forex inside bar, one can wipe out 10 consecutive losses in a single trade. That says all about the power of trading this strategy, forex inside bar. Illustration 7: After initial rally in the price an Inside Day is formed. When the price breaks high of the Inside day the long entry is taken placing the stop just below the low of the Inside Day.

Illustration 7A: A reward of pips for a risk of 70 pips comes to Risk reward ratio of almost ! As we know, at a place of key resistance and support areas, big time players start an activity of accumulation or distribution respectively.

From a daily chart perspective, Some times this activity lasts for multiple days and the price keeps on making lower range every following day. As we are aware, longer the consolidation, longer will be the movement after the breakout. Hence Multiple Inside Days offer a great trading opportunity as the breakout from the range leads to heavy movement in the price after the forex inside bar in a particular direction.

Sometimes trading Multiple Inside Days can be tricky as the probabilities are more in this scenario compared to a single Inside Bar breakout. If we understand the underlying psychology under the formation and breakout of Multiple Inside Days, we can trade the same with high degree of success. The most authentic and reliable way of trading Multiple Inside Bars is to trade the breakout of the initial Inside Bar The first Inside Day in the series.

Of course with momentum! As far as stops are concerned, we place it on the opposite side, either just below or above the first Inside day, depending on the direction of the trade. Illustration 8: In an ongoing downtrend, price consolidates for more than a week and then forms 3 consecutive inside days. Bar No 1, 2 and 3 respectively are consecutive Inside days.

As per our rule, we always trade with the trend and a short order is placed just below the low of the first Inside day being bar no, forex inside bar. It is pertinent to note that the breakout downside takes place with momentum. Understanding the breakout traps becomes highly essential to trade this strategy effectively. A breakout trap essentially means, forex inside bar, the price breaks out in one direction and lot of traders jump in to the trade in the direction of the breakout.

Then the price comes back and breaks out in the other direction with momentum and continues its move in the same direction. In this case all the traders who entered their positions on the first breakout are trapped in the bad trade. To overcome such kind of traps we follow certain rules and they are. So as you can see the Inside bar breakout strategy can be very powerful when used in the correct context.

Inside bars form all the time, but by following some simple rules we can really start to filter out those high risk trades and avoid being caught in breakout traps. I live and breathe forex inside bar action every day, and the Inside bar breakout is just scratching the surface when it comes to indicator free trading. This is just one of the price action trading techniques I use in the markets. I hope this article has been an eye opening on how simple price action based strategies like the Inside bar can actually be molded into powerful trading systems.

Guest post by Anatasius from The Forex Guy. Pingback: Ending the Aussie free-fall? Forex Crunch. Thanks for your comment.

It is one of the simplest but an outstanding strategy if traded with proper guidelines. Anatomy of an Inside Bar For the better understanding of an Inside Forex inside bar, its structure and its precedence, you can see the illustration below. Illustration 1: Anatomy of an Inside Bar Why Inside bars occur Inside bars occur in the following circumstances A.

Reversal Key resistance area : At a point of strong resistance, big time sellers start building short positions and the buyers start covering their longs. Illustration 3: Inside Bar at a key support area resulting in strong reversal. Breakout area An area of key resistance or support gets broken only forex inside bar there are a large numbers of players willing to bid above or forex inside bar below such key areas respectively.

Consolidation after a strong move in a single direction : When the price makes a substantial move in a single direction, it halts and starts consolidating to facilitate the below noted parties, before it makes next round of movement in the same direction.

The parties who are in the forex inside bar direction and want to cover their positions with profit The parties who are in the wrong direction and want to cover their loss. The parties who want to add to their profitable positions, forex inside bar.

How to trade Inside \u0026 Outside Bar strategies...

, time: 13:07Master the Simple Inside Bar Breakout Trading Strategy - Forex Training Group

· The Inside Bar is a simple but powerful candlestick pattern. It can help you better time your entries with low risk. The best part? You can use it to trade with the trend or, market reversals. Heck yeah! But first What is an Inside Bar and how does it work? An Inside Bar is a candle that’s “covered” by the prior candle. Here’s what I mean · Last Thoughts on the Inside Bar Forex Strategy. The inside bar as an entry signal does not offer the trader an edge over the market in most scenarios, however the inside bar used for reading the price action story can be very useful. It is important to understand why the market moves like it does The inside bar is a candle in which the body is fully contained by its preceding candle. The Inside Bar formation suggests that the market is pausing or consolidating. The bulls cannot create pressure for a higher high and the bears cannot create a lower low. You can trade the inside bar

No comments:

Post a Comment