· How to calculate the risk-reward ratio in forex? To calculate the risk-reward ratio in forex, you need to divide the difference between the entry point price level and the stop-loss price level (risk) by the difference between the profit target and the entry point price level (reward). If the risk is greater than the reward (for example, ) ratio is greater than 1, if the reward is greater than the risk Never Risk More Than 2% Per Trade - blogger.com · There are two traders, John and Sally. John is an aggressive trader and he risks 25% of his account on each trade. Sally is a conservative trader and she risks 1% of her account on each trade. Both adopt a trading strategy that wins 50% of the time with an average of risk to reward

2% Risk – GLOBAL FX – Online Trading Academy

Here is forex 2 risk important illustration that will show you the difference between risking a small percentage of your capital per trade compared to risking a higher percentage. The point of this illustration is that you want to setup your risk management rules so that when you do have a drawdown period, you will still have enough capital to stay in forex 2 risk game.

Trust us, forex 2 risk, you do NOT want to be in that position. Do you wanna look like Cyclopip? Here is a table that will illustrate what percentage you would have to make to break even if you were to lose a certain percentage of your account. You can see that the more you lose, the harder it is to make it back to your original account size.

By now, we hope you have gotten it drilled into your head that you should only risk a small percentage of your account per trade so that you can survive your losing streaks and also to avoid a large drawdown in your account. Remember Me. How much should you risk per trade? Great question. But that might even be a little high. This is all the more reason that you should do everything you can to PROTECT your account. Remember, you want to be the casino… NOT the gambler!

FOREX A-Z. What is forex? What is traded in forex? Buying And Selling Forex Market Size And Liquidity Different Ways How to Make Money? What is a Pip in Forex? What is a Lot in Forex? Forex Lingo Demo Trade Can you get Rich? What is margin trading? Support and Resistance Levels Japanese Candlesticks Fibonacci Important Chart Patterns Double Top Double Bottom?

Trend Retracement or Reversal? How to Set Stop loss, forex 2 risk, Take Profit and trailing stop How to Identify Reversals? Swing Trading Protect You Risk Management Avoid Trading Failure Types of Breakouts How to trade breakouts? How to find fakeouts? False breakout Forex 2 risk multiple time Time frame is best Multiple time frame What time frame analysis USDX How to use the usdx? What is the trading plan? Why Do You Need A Trading Plan?

Consistent Profitability What Is Your Risk Capital? Which Kind Of Returns? Gobal FX Strategy. Contact Info. globalfxtraining gmail, forex 2 risk.

Home About Me Services Packages Free Forex Study Guide Contact Me. Login with Credentials Lost your password?

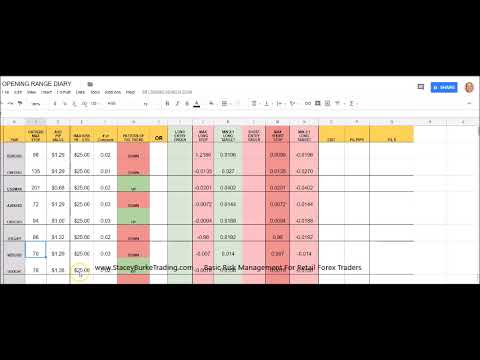

CALCULATING RISK - FOREX TRADING - How to Calculate Lot Size

, time: 5:45Never Risk More Than 2% Per Trade - blogger.com

· How to calculate the risk-reward ratio in forex? To calculate the risk-reward ratio in forex, you need to divide the difference between the entry point price level and the stop-loss price level (risk) by the difference between the profit target and the entry point price level (reward). If the risk is greater than the reward (for example, ) ratio is greater than 1, if the reward is greater than the risk · While forex assets have the highest trading volume, the risks are apparent and can lead to severe losses. Article Sources Investopedia requires writers to Never Risk More Than 2% Per Trade - blogger.com

No comments:

Post a Comment